Claim your freebie!

Free Emergency Fund Challenge

- Have a savings buffer

- Be calm & more in control

- Be able to make good financial decisions

- Avoid bad debts

Take a course!

- quickly reduce anxiety & begin to feel more confident with money

- implement simple systems, saving time & money with easy to follow money tips

- start paying off debt, build emergency savings & security

With the level of consumer debt in the UK, I thought a post to help with becoming debt free would be useful. As at September 2018, the average household has nearly £16,000 in debts, not including a mortgage. While many people may feel that they can service these debts at present, it is a worry for the future.

“Individuals are juggling finances to get by, which is an early warning sign of impending financial difficulty. About 15 million households are showing one or more signs of actual financial distress...making minimum payments on their cards, being hit regularly by overdraft charges, using credit to get to the end of the month and pay for essentials.” -Peter Tutton, StepChange Debt Charity

Credit nightmare

You may have heard me say before, but I will say it again. Minimum payments on credit cards are the work of the devil! If you have £2500 on a credit card, and don’t spend any more on it, paying the minimum payment only, will take you around 26 years to pay it off! I am not kidding – check it out for yourself. On a card with a typical APR it will also cost you £3444 in interest over that period. Now I don’t know about you, but that seems like a whole load of money to be throwing away.

Be interested

Another worry is the interest rates. They have been the lowest they have been in years, and have been that way for a while. However, there is economic turmoil and turbulence around the corner with the worldwide political situation. Inflation is also having an impact on the money we have available to spend, with living costs rising and no wage rises. What happens if the interest rates do go up? What happens when the cost of living increases? Will you still be able to pay your mortgage and service your debts then? This handy calculator will let you see what a difference an increase in the interest rate could make to your debts.

If you feel that you are struggling with debt, then you might find my Practical Guide to Becoming Debt-free useful.

Help with becoming debt free

For me, the solution is getting your debts paid off as quickly as possible, if they are costing you money. i.e: if you are paying more in interest than you are making. There are certain exceptions, where people are borrowing money at a low rate, investing it and making money from that investment. That’s good thinking, so don’t be put off that strategy, if you are keeping an eye to the future interest rate rises, and how they might affect the interest on your borrowing.  For most people though, with debts on credit cards, this debt is costing you, both in financial terms and often also in emotional terms. The strain on a family with worrying debts is colossal, and taking that first step to dealing with them is often enough to remove a great deal of the strain. Don’t waste one second worrying about how you got into this situation. Instead let’s focus on getting out of it. The following are great ideas for help with becoming debt free

For most people though, with debts on credit cards, this debt is costing you, both in financial terms and often also in emotional terms. The strain on a family with worrying debts is colossal, and taking that first step to dealing with them is often enough to remove a great deal of the strain. Don’t waste one second worrying about how you got into this situation. Instead let’s focus on getting out of it. The following are great ideas for help with becoming debt free

Set a lofty goal

Work out how much debt you have (I know it’s scary, but don’t think too much about the total figure. It’s just numbers!) Then set yourself a goal for getting this paid off. Don’t make it a crappy little goal that means you pay 10 quid a month for the next 20 years. Make it a big goal. A fecking massive goal! One that excites you to think about. At this point forget about HOW you are going to make it happen and just focus on how you will feel WHEN it’s paid off. Now work out how much you need to pay towards your debt each month to achieve your goal. Again, don’t worry about how you are going to find the money – we will come to that. I hope that your goal seems a little (or a lot) scary and a bit impossible. That’s good! Now get yourself a visual reminder of this goal. A chart on the wall, an app on your phone, or a jar that you can fill with sand as you progress. WHATEVER you want, but get a visual reminder, because it will help to keep your focused and motivated.

Join an online community

If you do this, you will get the support of others who are in a similar position to yourself. Find the courage to post, even if you do it anonymously, and be honest about your situation and your goal. Publicly declaring it means that you are much more likely to achieve it.

Pop along and join my women’s only Your Money Sorted group, where I offer regular free challenges, which will help to speed up your journey.

Friendships

Get your friends on board. I don’t mean asking them to give you the money to pay off your debts. Be brave and tell them about your situation. You may even find that many of them are in the same boat.

Explain to them that you have a goal to pay off your debts and that you may need to make some sacrifices in the next wee while. No exchanging of expensive gifts, no weekends away and no expensive meals out. Explain that you might not be able to go out as often, and ask for their support with this. If they are friends worth having, they will support you totally and be willing to rearrange outings to suit you. Rather than an expensive meal and a night on the town, a pot of pasta and a couple of bottles of booze at your house will allow you to still enjoy each other’s company, without comprising your debt free goal.

Switch to 0% cards and start snowballing

Switch as much of the debt as you can to 0% cards, though check out this information to work out the cheapest way of doing this.

Depending on the fees for switching, and the length of time you wish to pay it back over, you could be cheaper staying on a credit card with a low interest rate. Please use a soft search to check which cards you have the highest chance of being accepted for, otherwise you could find applying for multiple cards, could affect your credit score badly.

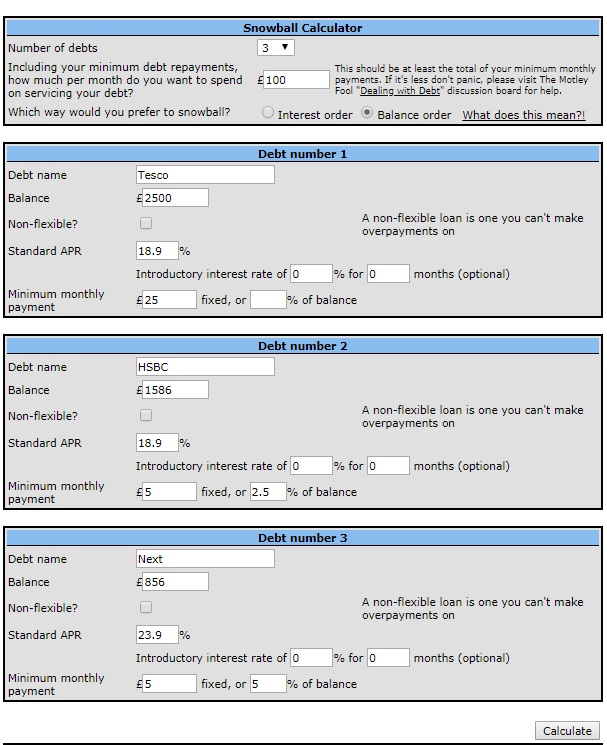

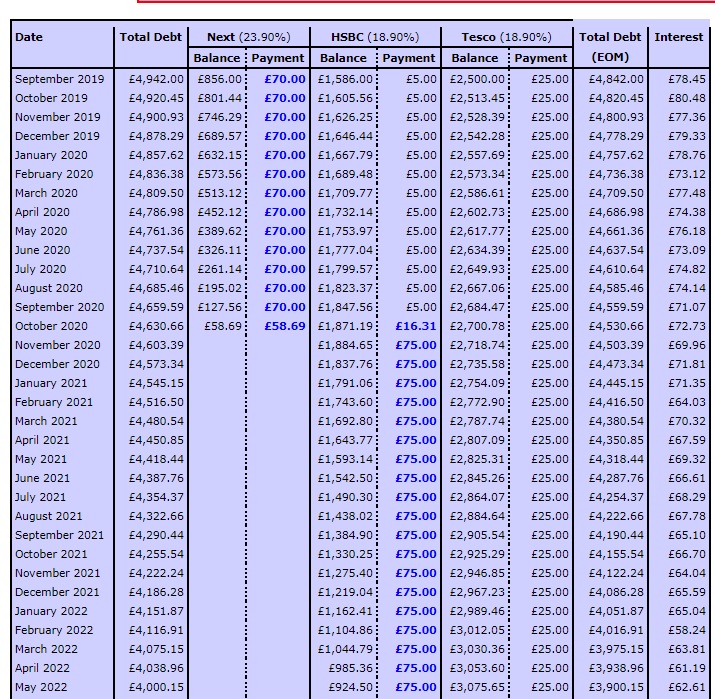

Start snowballing your debts! This simply requires you to gather details of all your debts - total owed to each lender, interest rates, minimum payment requirements, and how much you can pay towards your debt each month. Once you have that information, simply enter it all into this debt snowball calculator, and see what it suggests.

|

Why is it called a snowball? Because, like a snowball going downhill, it gets bigger and gathers momentum, until it is hurtling along at breakneck speed. Once you get started snowballing your debts, you will find that excitement and success will lead you to paying it off more quickly than you imagine.

Use your talents

I am not suggesting that you need to take to the streets and busk or go and strut your stuff in the nearest strip joint (though I have heard the pay is pretty good, so if you fancy it……), but I know that you have talents that you could sell.

Could you make some extra cash by tutoring children, teaching music lessons or taking kids for swimming lessons? Do you have web design, secretarial skills, proofreading or a million other talents that you could sell on Fiverr?

Do you love ironing or clearing? Could you offer your services for these types of jobs?

Do you have a creative talent such as art, photography or card making where you could sell your items on Etsy, Facebook or Pinterest?

Decluttering

This is one of my suggestions that comes up repeatedly. You might think this is purely as a money-making idea, but it isn’t. Decluttering is amazing for making you feel energetic, positive, and enthusiastic. It also really helps you to create space in your life to being more good things into it. A bonus, of course, is that you can sell much of the clutter and bring in some extra money to put towards your debts. Using eBay and Facebook marketplace, are two of the easiest ways to sell unwanted goods.

Use your home

Can you make money from your house? What about renting out a room or your garage or even your driveway? Do you have a large garden where you could rent out areas for allotments?

Could you make money from holiday makers by renting out your house through Air BnB? Being even more radical, could you move in with family for a period and rent out your house on a longer-term lease?

Transport costs

Could you cut down dramatically on your transport costs by walking or cycling? A daily commute of 5 miles each way, done on a bike rather than by car, is estimated to save over £1100 per year, even after buying a £400 bike. That’s nearly £100 a month. Another bonus is that you will burn an extra 600 calories each day, meaning that you could cut down on weekly slimming classes or gym memberships. Either that or you could eat more chocolate or drink more wine ????

List it!

If you employ this tactic throughout the time that you are paying off debt, and continue afterwards, you could save yourself £1000's of pounds over your lifetime.

Research shows that impulse purchases account for a staggering £2000 per person, per year in the UK. That’s a lot of money getting wasted right there, isn’t it? The solution is simple. Always shop with a list. This means that you think about what you need before you leave the house and you get into the habit of only buying what is on your list.

Recommend Plum and Chip

This suggestion is one that will help you to put money into a savings account each month, which you might think is not for you if you are in debt. However, don't dismiss it too quickly, as it can help you to spend less and get your debt paid off more quickly

If you want to help yourself, and others, to save then Plum and Chip are worth investigating. These are both new kids on the block in the finance world and they bring a new and exciting element to saving money. Both are run by apps, connected to your bank securely and they analyse your spending and every few days will transfer a small amount of money into your Plum or Chip savings account.

Plum and/or Chip could be a powerful friend on your journey to becoming debt free. Both will help to save small amounts all month, which can then be transferred into paying off debts.

Some extra income

As well as making saving fun and easy, Plum will reward you to refer other people, making you more money to pay off debt. The referral fees are generous, with Plum paying £25 for every 3 people you refer.

What to do now?

If you have enjoyed the suggestions in this post, then why not download my Practical Guide to Becoming Debt-free to give you help with becoming debt free.

Feel free to come along and join my Your Money Sorted group for women who want to make the most of their money and their lives, by creating a happy, content, and successful money story.

Eileen x

I am Eileen, Your Money Sorted coach, working with UK based women helping them to become financially empowered. Being calm, confident and in control of their finances, allows them to concentrate on the things that are important to them. Previous clients feel that they can spend more quality time with family, friends and having fun. That has to be a great thing doesn't it?

I am Eileen, Your Money Sorted coach, working with UK based women helping them to become financially empowered. Being calm, confident and in control of their finances, allows them to concentrate on the things that are important to them. Previous clients feel that they can spend more quality time with family, friends and having fun. That has to be a great thing doesn't it?