Take a course!

- quickly reduce anxiety & begin to feel more confident with money

- implement simple systems, saving time & money with easy to follow money tips

- start paying off debt, build emergency savings & security

Spring cleaning your finances is always a great idea - find out how to do it by reading the blog post below. It is surprising just how simple it is. There is some more information below that will give you some tips about managing and saving money, by blowing the cobwebs off your cash!

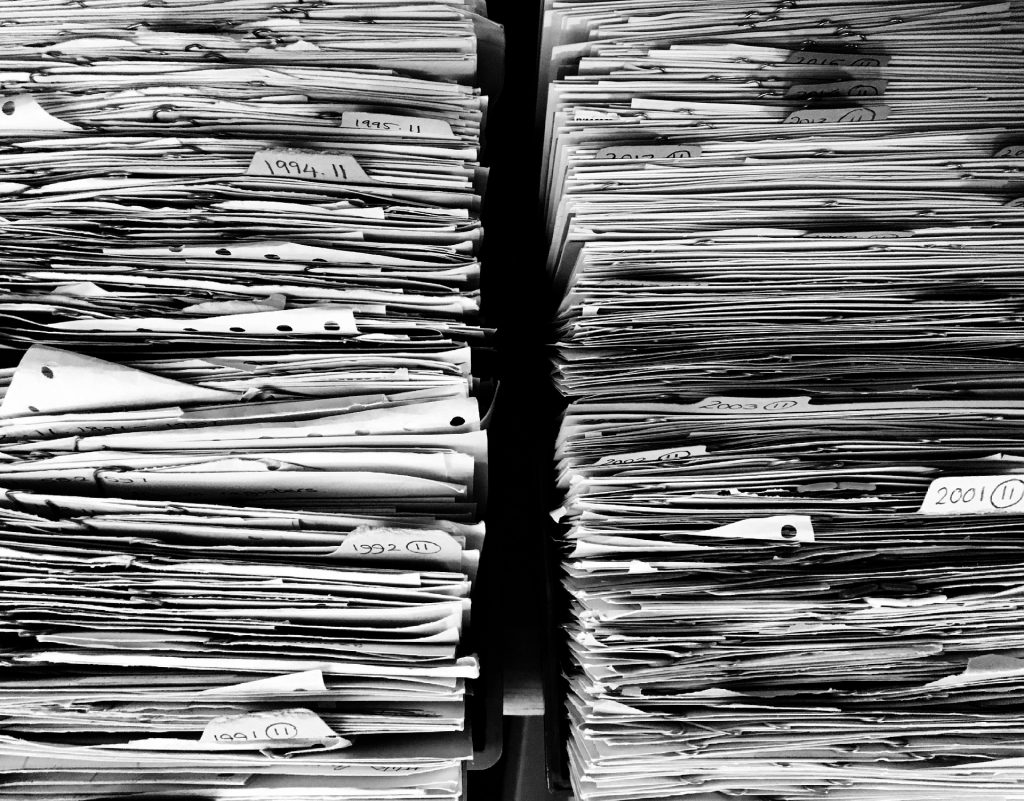

Paperwork

The first step in saving money is to get into that pile of paperwork and get it sorted out. I like to have a tidy out every so often and find it is much less painful if I sit by the stove with a glass of wine and piles of paper!

Get a filing system sorted out - buy some pretty storage if it helps to make the process less painful - and then start sorting the paperwork to go in it.

Make 3 piles - one of things you need to keep, one of things you MIGHT need, and one of the rubbish! As soon as you can, get the "keep" pile filed away - it looks neater and makes you feel as if you are actually getting somewhere

In the "maybe" pile you should keep things like old credit card or bank statements and old loan or mortgage agreements, just in case you need them later. You might want to take photos of them and then store them on the PC and put the paper copies into the chuck pile - whatever feels right to you. If not, then bung them in the loft or somewhere out the way of your everyday filing system.

I love then chucking anything that is rubbish in the stove and watching it burn - very therapeutic! If you are not burning your rubbish pile, then be very careful with it - you should really shred it or make sure that any of your details are not able to be read. Take a minute to read this useful information on identity fraud.

Income and expenditure

Once you have sorted the paperwork it is time to get started on the figures, to really help with your quest of saving money. Grab 3 month's worth of bank statements and add up the spending in each category. If you then divide it by 3, you will get an average monthly spend for each of these areas. If you would like some help with this check out this great spreadsheet which will make it super simple

Get started on spring cleaning your finances

- Make a note of all your income, including child benefit, penisons, CSA etc

- Add up all your direct debits and standing orders

- Total up your everyday expenses, such as food, clothes and nights out

- Add up all your expenditure

- Subtract your expenditure from your income

- Look at the figure you have left - is it a plus or a minus?

This simple task can help you to identify where there may be issues in your monthly spending. However, it's also useful to complete another task, which will help you to look at your overall financial picture.

Net worth - Do you know what it is?

Your net worth is the difference between what you OWN (your assets) and what you OWE (your liabilities). Assets include things like your house, bank accounts, pensions, your car (as long as you will own it outright at some point) and anything else you own that is worth money. Liabilities include things like a mortgage, credit card debt, car loans, store card debt and any other money you owe to people. Your net worth gives you clear picture of your financial health and it can be either positive or negative, depending on whether you own or owe more.

Why is your net worth important?

Knowing your net worth is an important part of planning for your future. Overall you should aim to grow your net worth throughout your life, as this will allow you more freedom to do what you want rather than always relying on your next payday. If you are growing your net worth each year, you know that you are making good financial progress.

How do you increase your net worth?

By reducing the amount of money that you owe and increasing the value of the things that you own.

- Increase your income—look at ways of bringing in more money

- Spend less than you earn—cut back, think before you spend, get good value for each purchase

- Start an emergency fund—instead of borrowing to pay for emergencies, you can use your fund

- Consider paying off debt—the interest payments on your debt cost you money every month. In most cases, the sooner you can pay your debts off the better.

If you would like some help with sorting your finances, why not get in touch with me to see how I could help you to improve your situation. I would really love to be able to help you.

Eileen X