Take a course!

- feel good about money, enjoy life more and feel like YOU again

- reduce stress levels & create time for you & your family

- pay off debt, make smart savings & build wealth

How to start saving money more quickly and build a bigger savings pot is on the mind of many people just now.

This post has some brilliant suggestions to help you to start saving more money on a regular basis, without it feeling like a chore.

Set a monetary target.

Decide what you want to save for and how much you will need. It might be for an emergency fund of 3-6 months' of essential expenses or it might be for next years' holiday, but regardless, having a target makes it easier to save.

I am saving for a campervan for my retirement and my pot shows me the percentage towards target. Even though it's only at 7%, it’s really exciting to see it go up! Previously, I felt defeated and dejected because I felt saving up for a campervan was totally impossible!

If you are arty, you can create a tracker yourself. I've seen some stunning Mandala ones that have been created by people to help keep them on target. There are also some gorgeous ones with trees with individual leafs, each representing a percentage towards your target. I'm sure if you are arty, you will have loads of ideas, but if you are stuck try Google for inspiration,

If you are not arty, but like the idea of having a physical tracker, then there are loads of printables online.

There are also some brilliant apps help you to track this.

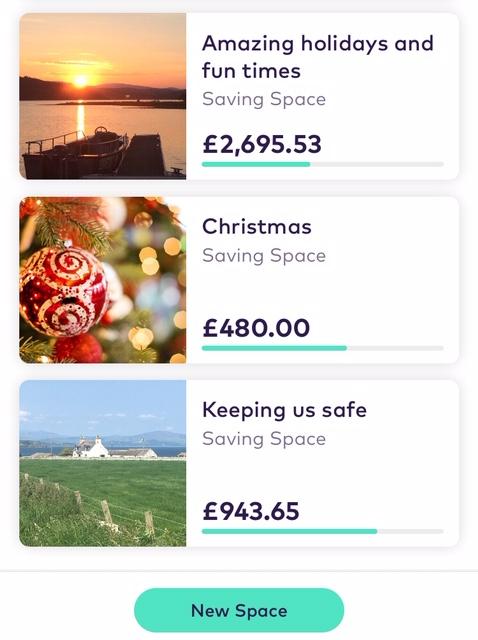

Have separate accounts for different things

Keeping your money in different places makes it easier to keep track of how much you have saved towards each thing. I find this is easiest when using my "spaces" in my Starling bank account. It's just a normal current account, but it allows me to create as many spaces as I want. The money in here is hidden from sight when I log in to my account, so I am not tempted to spend it! However, one click takes me into my spaces section and I can see exactly how much money I have saved for Christmas, holidays, insurance etc.

Change the name of your bank accounts

This sounds mad, but it honestly makes it feel so much more fun to save money. Imagine having an account called “We’re going to Disney” instead of "savings account". It sounds so much more inspiring and motivating, don't you think? What else could you have? “My gorgeous new kitchen” "My perfect handbag" "My f**k it fund".

Photos for inspiration

The challenger banks are amazing for allowing you to add photos to your savings spaces, so as well as having inspiring name, you can physically see your goal! Imagine seeing a gorgeous beach or handbag as you open your pot - it's a wee bit more motivating than seeing a corporate bank logo isn't it? I love opening my savings spaces and seeing all the bright colours of my photos.

Round up or Save the change

This is a brilliant initiative that many of the banks now offer and it makes saving a complete doddle. Once you have set it up on your account (normally easily done through your banking app), every time you spend the bank will automatically round up the transaction to the nearest 50p or £1. eg: if your purchase is £8.35 it could pop 65p into your savings account. It might not seem a lot, but you won't even notice it going and I promise it will add up.

You can do this, even if you still use cash, by setting up a spare change pot. We have a family one; everyone puts any spare change into it and we and buy a takeaway every so often with it. It's fab, because it always feels like a free takeaway!

If you use a spare change pot, then you might worry about having to pay for the takeaway with hundreds of coins, but some of the banks have this covered! RBS, Natwest and Metro bank have coin sorters, where you can tip your coins in and the bank will give you notes instead. Other banks probably do too. Some of the supermarkets also have coin sorters, but they take a percentage for doing it, so you would be cheaper using the bank, if there is one near you. However, if there is no bank near you, then paying to get it sorted is probably preferable to turning up at the Indian with a huge pot of coins!

Set up a standing order immediately after payday

If you want to know how to start saving money, then a standing order into your savings account, immediately after payday, is a simple way to do it. Often people say they will save what's left at the end of the month, but this rarely works, because the money generally disappears.

If you have never been a saver, then this might seem scary! But once you get used to it, it's a great feeling. If you have never done it before, then stop reading now and do it! Even if it’s only a couple of quid – just do it! Go on.......

Reduce the amount and increase the frequency

If setting up a standing order still feels a bit scary, then here is a question for you.

Which feels better to you? £40 per month or £10 per week?

If £10 a week feels less scary, then simply set up a weekly standing order into your savings account, rather than a monthly one. If you chose £10 per week, then you made a great choice, because that is actually £43.33 a month, so you are learning how to start saving money really quickly!

Have some extra cash?

Often when people save money or make more money, they never actually see the benefit from the extra cash, because "lifestyle creep" happens and it gets spent each month. You know that old saying "Is that money burning a hole in your pocket?"? That's what often happens - it just gets burnt through really easily and you have nothing to show for it.

Instead of this, why not put it towards something that you really want? If you get a payrise, reduce your energy bills or finish paying off a loan, then invest that money in yourself, by setting up a standing order towards your savings goal. It's a really simple way of saving for something fantastic, without missing the money.

Save without even noticing

This is another of my favourite ways of saving, because it involves no thought or effort and your savings just grow, as if by magic! You give Plum access to your bank account (don't worry, it's legal and safe!) and it analyses how much you could save each month. Plum then automatically transfers the money every few days from your bank account, into a wee separate savings account that has been set up for you.

Plum will send you a notification to say that they have taken money and you can click on the app to see how much your balance is. I have turned the notifications off, so that I literally forget about my Plum account and then get a lovely surprise when I do remember! Squirreling away a few quid at a time adds up, so why not check it out for yourself?

Saving for longer term goals?

If you are saving for bigger, longer term goals, then you might think about investing, rather than saving. You could start with something like a stocks and shares ISA, which is easily accessible and easy to open online. A couple of words of warning though.

Firstly, remember that by investing in the stock market, the value of your investment can go down, as well as up and you could potentially lose all the money that you invest. However, if you are investing for the long term, then even if the value of your investment fell, if you left it invested then you would hopefully see it grow again over time.

Secondly, before choosing a stocks and shares ISA, you should compare the fees charged by the different providers, as this can vary wildly and can hugely impact on your investment.

Hi, I’m Eileen Adamson, money coach, empowering professional women to become happier, healthier and wealthier. By showing you how to make small, sustainable changes, I can help you create the financial security and freedom you deserve.