Claim your freebie!

Change Your Money Story

- Be excited for the future

- Feel empowered; in control

- See what’s holding you back & create new habits

- Have more money for fun

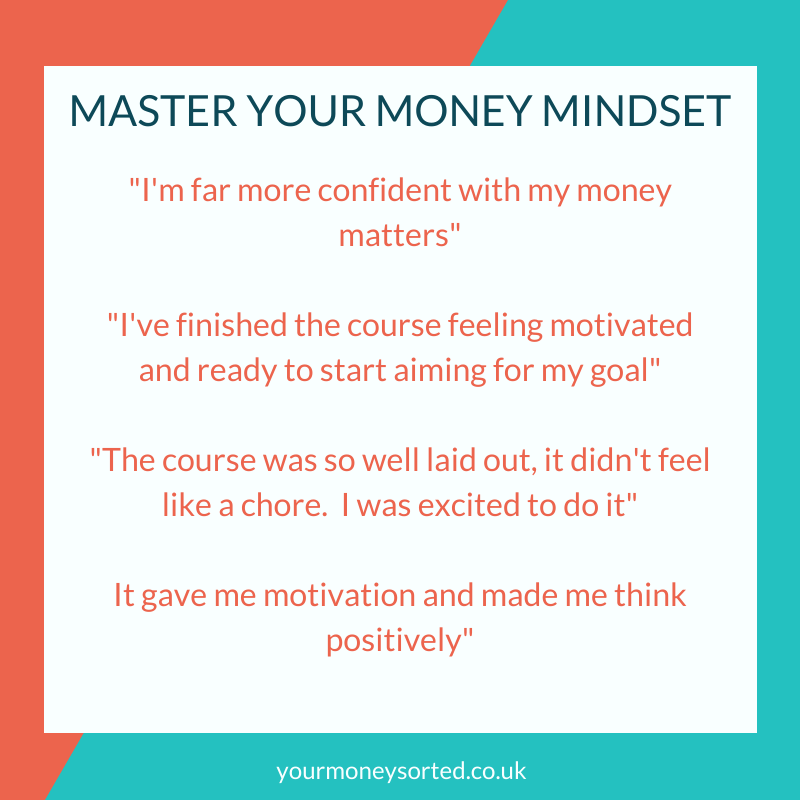

Take a course!

- understand your money blocks and why they make life difficult

- break old habits and build new ones to help you to feel in control

- change the way you speak about money and begin to feel great about it

What difference could having a motivated money mindset make to you? Not having to worry about money is the ultimate dream for many. Having enough money to live the life you choose, without having to worry about it sounds brilliant.

If you find managing money difficult, are in debt, or feel rubbish about money then becoming worry-free can seem totally impossible. It’s easy to then feel negative about money, making it more likely that you will never have "enough" and never feel truly content.

But it is possible if you can create a motivated money mindset

What I want to show you, is that nothing is impossible, especially if you start small, and set inspiring, motivating goals. The journey is exciting and fun because you are making decisions which are good for you and your family.

It could be that you want to achieve financial freedom, where you can leave work, and still generate enough money each month to live your ideal life. Or you might want to ditch the stressful career, take on a lower-paying job that you enjoy, but still be able to generate the income of your previous career. Your family might want to benefit from working part-time, but not take a huge drop in salary to do so. Or you might dream of early retirement, travelling around the world, and having enough money to do so easily. It could even just be the freedom to do something as simple as paying someone to do your cleaning, washing and ironing!

Regardless of what your ultimate dream is, you can make decisions to improve the quality of your life.

But where should you start?

Although we all have different dreams and aims in life, I think that there are basic things that we need to get in order, before we begin to create our financial freedom.

We need to become financially resilient; having the money to cope with most things that life might throw at us. Having enough money in a small emergency fund to cope with a broken washing machine, an unexpected car breakdown or the garden fence breaking provides us with a little security.

However, to have true financial resilience and security, we need to think about having 3-6 month's of essential expenses readily available. This would allow us to continue to pay for our basic needs if our family was hit with a redundancy, prolonged illness or other potentially life-changing event.

Click here to find out how you could motivate yourself and grow your wealth

There is free help available

It can seem impossible to think about this if you are finding it difficult to make ends meet at present, however I will show you how you can achieve this. Pop along and join my Your Money Sorted group where I will help you to start on this journey.

The first 3 steps will be to: - having a stash of money, for emergencies - getting rid of consumer debt - create an emergency fund of 3 - 6 months of essential spending.

Achieving all of the above on your way to financial freedom is much easier if you WANT to make changes to make these things possible. It’s about feeling excited about the changes, and making them seem easy!

Let's look at how we can make this easier

Start by asking yourself “What do I want?”

It’s a million-dollar question isn’t it?

Most of us find it easier to think what we don’t want! I don’t want to be so stressed out! Or to work so many hours. I don’t want to be so shattered by the time the weekend comes. I don’t want to be grumpy with those around me. Or to be so stressed about money. I don’t want to be in debt. I hate feeling stupid when it comes to money.

Some of those may sound familiar.

It’s so easy to focus on what we don’t want, but it really doesn’t help. All that does is brings more of what we don’t want into our lives.

Focusing on what we do want is a far more fun, uplifting, and useful process. The more that we can focus on what we do want, the more of that we can attract into our lives.

Let’s try again.

Think about the following questions.

1 What do I want my day to day life to look like? What do I enjoy doing? Which things do I want to spend my time doing? What would make my life easier? How does the thought of this life make me feel? Who do I want to spend my free time with? What do I want to do with them? How do they make me feel?

2 In an ideal world, what do I want my financial life to look like? How do I want to feel about money? What are my priorities around money? What do I want in terms of money? Organisation or management of money - any thoughts about how you want that to look?

3 In an ideal world, what do I want? What do I want my future to look like? Thinking long term, what do I want to achieve? What are the likely important events for me? Eg: Paying off debt, buying a house, promotion, travelling, having children, helping children financially, retiring

Focus on the future

This exercise should help you to focus on why you want to change, and why it is worth making the effort to change.

However it can be easy to become overwhelmed with all the other tasks you have to complete in a day, and to let this fall by the wayside.

The easy option is often to stick within your comfort zone, and not make any progress at all. However, the more positive and upbeat you can remain, the easier it is for you to make the changes required.

It's also useful to have reminders in our daily lives and I love this way of reminding me to be more positive about money and about life in general. It’s so simple, takes no time out your day and is automatic - brilliant for busy people!

Sign up to The Universe Talks for daily positive reminders. You can personalise it, and it will then automatically send you wee reminders each weekday either via email or through an app. It's a fun way of reminding us to stick with a positive mindset, and to look to the future instead of the past. The free version is perfect, so don’t get sucked into paying for anything! Go to tut.com and sign up for the notes.

Freedom and choice

Taking steps to improve your financial situation will help you to have the freedom to make choices that work for you and your family. It’s about being able to choose what you do with your money, rather than feeling restricted by it. If you would like some support with this, then please pop along and join the Facebook group.

Eileen x

I am Eileen Adamson, qualified Money Mindset Coach, empowering women to take control of their money, and to create the life they love. Come and join me and see how much fun it can be!